- This article reviews the main investment vehicles that stand out in 2024 due to their good prospects given the global context.

- It is particularly aimed at fund managers, investment advisors, and entrepreneurs looking to know what types of financial assets have growth potential.

- At FlexFunds, we offer the possibility of issuing exchange-traded products (ETPs) that can enhance the distribution of your investment strategies. Contact us for more information!

2024 is proving to be a great year for financial markets. With inflation in the United States appearing to be under control (dropping from 9.1% year-on-year in June 2022 to 3.3% last May), investors began to anticipate monetary policy easing by the Federal Reserve (Fed).

Currently, interest rates are in the range of 5.25%-5.50%. If the monetary body decides to cut them, equity assets would benefit, and global borrowing costs would decline slightly.

In other words, a “risk-on” scenario would be consolidated in which multiple investment vehicles would be favored.

What investment vehicles stand out in 2024?

1. Exchange-traded products (ETPs)

Exchange-traded products (ETPs) are investment instruments that replicate the movement of financial assets such as a set of stocks, indices, currencies, or commodities. They also include exchange-traded funds (ETFs).

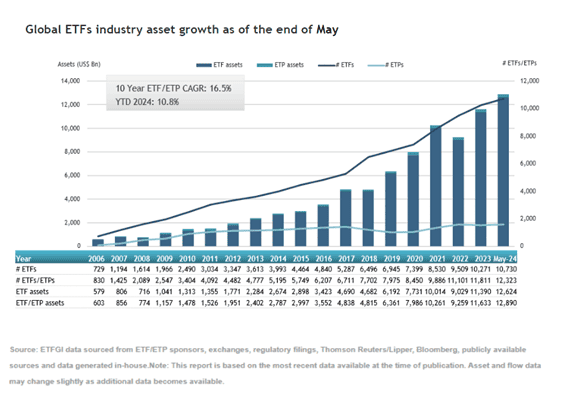

According to data from ETFGI, an independent consulting and research firm, the global ETP and ETF industry reached a new record of USD 12.89 trillion in assets under management at the end of May this year.

Moreover, net inflows for the month of May were USD 126.32 billion, resulting in a year-to-date record of USD 594.19 billion.

Among the most popular ETFs in recent months were those linked to the S&P 500, such as SPDR S&P 500 ETF Trust (SPY), Vanguard S&P 500 ETF (VOO), and iShares Core S&P 500 ETF (IVV).

2. Investment in REITs

Within the world of alternative investments, defined as those investments that are somewhat uncorrelated with traditional markets, we have REITs (Real Estate Investment Trusts).

REITs are real estate investment companies that invest in different assets in this sector and subsequently lease them. In this case, the cash flows generated by these companies come from the leased properties.

The good thing about this type of instruments is that they allow access to the real estate market without the need to risk a large capital and generally provide immediate liquidity if needed.

There are different types of REITs, each specializing in a specific segment within the real estate sector. For example, there are SOCIMIs (Sociedades Anónimas Cotizadas de Inversión Inmobiliaria) that specialize only in office rentals or parking space rentals.

This type of investment can be accessed through listed companies or investment funds that invest in such companies.

It is an alternative investment where investors acquire a stake in a fund and entrust their resources to a management company that professionally manages them.

3. Green bonds

Government and private initiatives to promote environmental projects have given rise to green bonds. These are instruments to finance projects related to clean energy, climate change adaptation, water resource conservation, or more sustainable mobility.

According to S&P Global Ratings, the issuance of these sustainable bonds is expected to increase from USD 980 billion in 2023 to a maximum of USD 1.05 trillion during 2024.

To access these bond issuances more diversely, one should do so through investment vehicles such as funds or ETFs.

4. Stock market

During 2022, equities lost much of their value, and very few companies managed to protect investors. However, in 2023, the situation changed considerably, and in 2024, the upward trend continues.

The two main reasons are the expectations of interest rate cuts by central banks and the mass adoption of artificial intelligence (AI), an innovative technology that promises to boost productivity and create significant businesses.

According to Goldman Sachs researchers, if Nvidia represents the first phase of AI commerce, the second phase will focus on other companies helping to build infrastructure related to the sector. Meanwhile, the third phase will involve companies incorporating AI into their products to increase revenues, and the fourth phase will be about productivity gains related to AI that should be possible in many companies.

It is worth noting that an equity-based strategy can often be securitized through FlexFunds solutions. To find out how, contact us.

5. Crypto assets

Increasingly adopted worldwide, cryptocurrencies experienced one of their best years in 2021, not only in terms of appreciation but also in the significant media impact they had globally. Although the situation reversed in 2022, these assets regained prominence in 2023 and became widespread in traditional financial markets in 2024.

In January, the United States Securities and Exchange Commission (SEC) approved the launch of spot bitcoin ETFs, marking a before and after, mainly because it attracted capital from investors who wanted to bet on the famous cryptocurrency but were unwilling to manage the conventional purchase process (such as opening an exchange account, etc.).

In fact, these funds exceeded USD 200 billion in trading volume just three months after their launch. Although there are still many questions surrounding digital currencies, especially related to legislation, they continue to grow, and their integration with conventional markets is a testament to this.

It is important to remember that many investment vehicles can be securitized through FlexFunds.

For more information, do not hesitate to contact our specialists. This way, we will provide the most suitable solution for your needs.

Sources:

- https://www.nasdaq.com/articles/$200-billion:-us-bitcoin-spot-etfs-top-$200-billion-in-trading-volume

- https://www.goldmansachs.com/intelligence/pages/ai-infrastructure-stocks-poised-to-be-next-phase.html

- https://www.spglobal.com/_assets/documents/ratings/research/101593071.pdf

- https://etfgi.com/news/press-releases/2024/06/etfgi-reports-assets-invested-global-etfs-industry-reached-new-record