ETPs (Exchange Traded Products) are listed products, such as stocks or company shares. ETP’s are launched with the objective of replicating the performance of an underlying asset and generating profits, but with a series of advantages in terms of their structure, liquidity, and capacity to distribute the investment strategy.

These products have experienced exponential growth in less than a decade, as investors have identified their usefulness in meeting the challenges of today’s financial world. FlexFunds, a leading company in the creation and launch of investment vehicles, analyzes the key trends guiding the ETPs market in 2022.

Status of the ETP market in 2022.

ETPs remain on the radar of investors looking for new options to expand their portfolios. We are currently at a time when competition in the financial markets drives innovation, and this product provides solutions.

Thus, according to the independent research and consulting firm ETFGI1, the ETP market, including exchange-traded funds (ETFs), has accumulated a total of US$ 43.42 trillion in net inflows from January 1 through April 30, 2022.

According to ETFGI, cumulative net inflows over the past 12 months (April 30, 2021, through April 30, 2022) total $122.70 billion.

April 2022 represents the 25th consecutive month with net inflows. Thus, we can say that the market for listed products continues to rise.

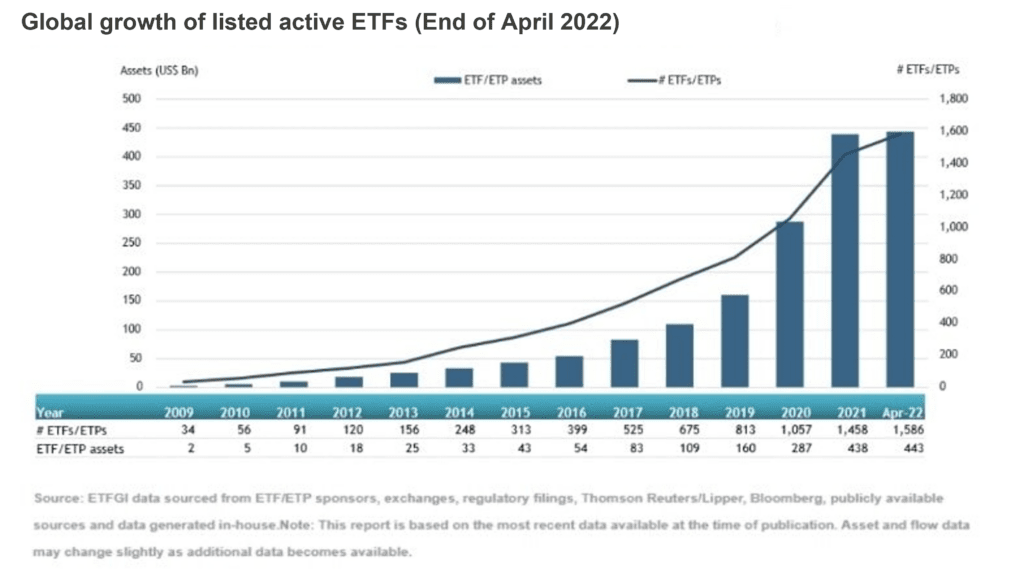

The graph below shows that listed products have experienced substantial growth over the past few years. At the end of April 2022, 1,586 ETFs/ETPs were listed, with a total asset volume of US$ 443 billion.

In this regard, it is worth mentioning how the Swiss firm SIX Group2 highlights that the demand for investment opportunities “is also reflected in the expansion of financial products by issuers.”

What are the key trends for growth in ETPs?

What is the reason for the success of Exchange Traded Products (ETPs)? It is one of the most efficient solutions for structuring investment vehicles.

Given the current conditions, there are marked investment trends that will be key to the development of exchange-traded products.

Increased exposure to alternative assets.

High-worth individuals are increasing their exposure to alternative assets to maximize their returns and diversify their portfolios.

Specifically, the segments representing this trend are as follows:

- Private Equity.

- Private Debt.

- Real estate investment funds.

- Renewable Energies.

- Infrastructure.

Alternative investments try to take advantage of the inefficiencies in the financial markets. In an era marked by war (Russia’s invasion of Ukraine) and high inflation, it is not uncommon for private banking clients to opt for uncorrelation strategies with the capacity to obtain extraordinary returns.

Usually, real economy asset, such as real estate or infrastructure investments, offer a safe haven from inflationary rises and market volatility.

In addition, alternative investments generally provide stable and growing cash flows, with limited competition and high barriers to entry.

However, if there is one thing that characterizes alternative investments, it is their lack of liquidity and difficulty finding the proper infrastructure to distribute them. For this reason, ETPs are one of the keys to its development.

Equities and sustainable investments.

Besides alternative investments, equities also occupy an important place in launching listed products.

In this regard, an article by Natixis Investment Managers specialist Nicholas J. Elward3 indicates that “increased market volatility is driving some investors to seek actively managed ETFs. The reason is that they expect managers to be able to mitigate volatility and downside risk.”

However, Mary Hagerman (manager and investment advisor at Raymon James) says that investments in companies that adopt environmental, social, and governance (ESG) criteria will continue to generate interest. One would expect to see a growth in ESG-related investment vehicles.

The fact is that sustainable investment is considered to be a behavioral change by investors and not just a fad. There are several reasons for this:

- Alternative energy sources are competitive.

- The energy demand is expected to grow by 2040 (according to the International Energy Agency).

- It is supported by public authorities (based on the commitments made in the Paris Agreement).

- There is a greater awareness on the part of all social agents to change the paradigm toward a greener economy.

Cryptocurrencies have burst into the world of ETPs.

The report released by Natixis Investment Managers also projects further entrenchment of cryptocurrency ETFs after the ProShares Bitcoin Strategy launched, the first of its kind in the U.S., in late October 2021.

This ETF, which replicates the performance of Bitcoin futures contracts but does not invest directly in the cryptocurrency, paved the way for launching more exchange-traded funds. An example of this is the creation of the Valkyrie Bitcoin Strategy.

As reported by SIX Group4, from the beginning of 2022 until May 2, 69 cryptos asset related ETPs were created on the SIX Swiss Exchange market. There are already about 161 ETPs on cryptocurrencies available on this market.

ETF Trends founder and CEO Tom Lydon stated that “financial advisors are increasingly looking for exposure to alternative assets and interest in cryptocurrencies is increasing.”

Investors themselves are driving the growth of exchange-traded products.

The world’s largest asset management firm by wealth size, BlackRock5, stresses that exchange-traded products, especially ETFs, have the opportunity to gain more ground as they “are increasingly being used in portfolios to seek outcomes; that differs from the broader market.”

At the same time, there is a “transformation in the financial advisory business model” and “an evolution in the way bond trading tends to favor ETFs for efficient market access.”

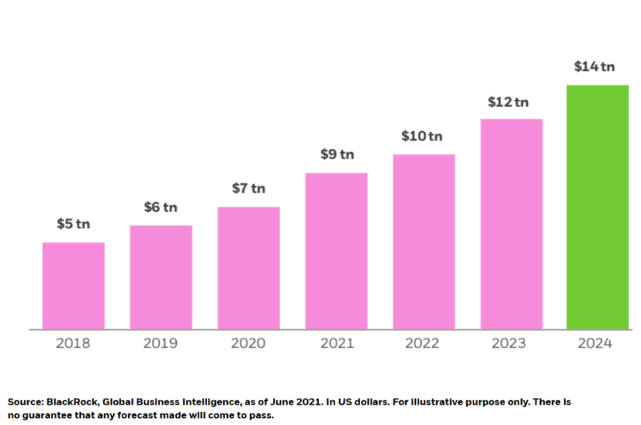

BlackRock forecasts that investors will increase their adoption of these instruments. However, they will remain “cost-sensitive” and demand quality more than ever, bringing global ETF assets to US$14 trillion by the close of 2024. The following chart shows the likely growth of global ETF assets.

We can highlight the following statement by the fund manager: “we believe investors are poised to increase their use of ETF strategies as tools to potentially beat the market in the coming years.”

ETPs provide the flexibility necessary for each strategy to be contained in the appropriate investment vehicle.

In this regard, FlexFunds provide asset management firms with customized solutions that facilitate the creation and launch of ETPs, fund accounting, and corporate administration.

With over $1.5 billion under management and over 250 issuances in over 30 countries, FlexFunds has helped financial institutions, hedge fund investment advisors, fund managers, and real estate investment managers improve the distribution of their investment strategies, facilitating access to global investors.

If you would like to learn more about our services, we invite you to schedule a personalized session with our financial experts to get started in the ETPs space.

Sources

- ETFGI reports Active ETFs listed globally gathered net inflows of US$10.44 billion during April 2022. www.etfgi.com

- 360° Perspectives on Indexing & Theme Investments; based on ETP & Indexing Guide 2021/2022 (www.six-group.com)

- 2022 ETF Trends to Watch, October 20, 2021 ()

- Hashdex Lists First Crypto ETPs on SIX Swiss Exchange (www.six-group.com)

- 4 TRENDS DRIVING ETF GROWTH. June 2021. www.blackrock.com