- Throughout the article, you will find information about the surge in listed investment strategies and their unstoppable growth, analyzing the I Annual Report of the Asset Securitization Sector. Download it here!

- The information in the article is useful for asset managers seeking an analysis of future trends in ETFs, an essential investment tool.

- FlexFunds enables the securitization of portfolios through different investment vehicles. Contact us!

The global economy is facing uncertain times. With the new cycle inaugurated by the tightening of monetary policy by major central banks, several unprecedented and difficult-to-explain situations have arisen.

One such situation in 2022 was the gap in the traditional relationship between fixed income and equity, which ceased to show opposing returns and instead resulted in losses on all fronts.

The increase in interest rates affected prices and favored sales in fixed-income markets, with yields rising from 1.51% at the beginning of the year to 3.88% at the end for US Treasury Bonds.

In this climate of uncertainty and change, few things have maintained their course, regardless of the Ukraine war, the energy crisis, and the enormous volatility in the markets. One of the most notable is the growth of the exchange-traded fund (ETF) industry despite the challenges faced by fixed-income and equity ETFs in 2022.

The Boom of ETFs Continues

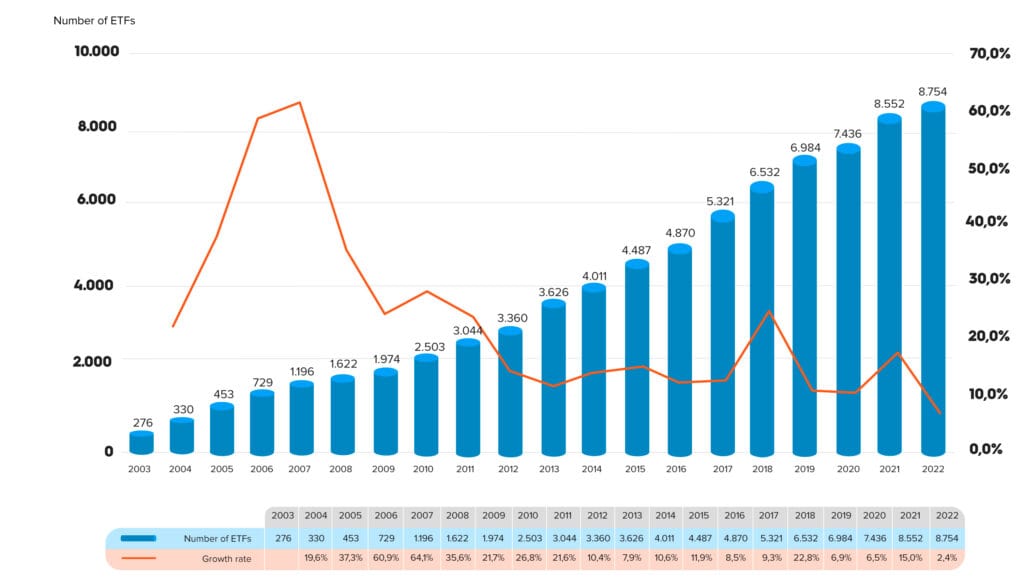

Exchange-traded funds (ETFs) have experienced significant growth in recent decades, gaining popularity among managers worldwide.

Their annual increase has been very robust, with an average annual growth rate between 2015 and 2022 of around 10%, reaching as high as 22.8% in strong momentum years like 2018.

It is an instrument that has revolutionized the market and how investors access financial markets. Its appeal lies in its diversification capacity, liquidity, low costs, and high efficiency compared to other investment vehicles.

Various sources report that an average of 3 ETFs are created daily in the United States. According to the 1st Annual Report of the Asset Securitization Sector by FlexFunds, this trend is expected to continue in the coming years.

ETFs vs. Traditional Mutual Funds

One of the figures that graphically reflects the growth of ETFs is the money flows into these vehicles compared to traditional mutual funds.

Despite 2022 not being a good year for both fixed income and equity, almost $600 billion (587,690) entered ETFs compared to almost $1 billion (950,180) outflows from traditional mutual funds. While ETFs continue to attract capital, mutual funds have been shrinking for five years.

ETFs Will Remain a Powerful Tool

In total, the difference between the flows of investment funds and ETF flows reached a value exceeding $1.5 trillion, confirming that ETFs have become the preferred investment vehicle for many asset management profiles.

More than 9 out of 10 respondents believe that the ETF industry is at a high or moderate growth level, with nearly half (46.2%) thinking that the growth is high. The reality is that they have become an essential investment tool for a wide range of managers.

“The popularity of ETFs is challenging the traditional asset management industry, and with proper selection, ETFs will continue to be a powerful and efficient tool for portfolio management,” states the report.If you have any questions or comments, feel free to contact us at info@flexfunds.com for more information or to discuss any aspect related to the report.