Modern securitization or repackaging strategies have become a bridge to reach multiple private banking channels for various types of assets, facilitating the process of converting the underlying assets into bankable assets. Bankable assets are a type of asset characterized by being distributable across different platforms in private banking.

Securitization is a process that not only allows any portfolio of liquid or illiquid assets, such as real estate, to be converted into securities; it also leverages the capacity of the exchange-traded product (ETP) to transform the underlying assets into bankable assets.

However, how such assets convert into bankable assets through an ETP is a complex process made possible by firms like FlexFunds, a leading investment vehicle structuring and administration services provider.

One of the main advantages of our asset securitization program is that it can facilitate access to multiple private banking platforms: the company sets up independent, fund-like investment vehicles for strategy management and global distribution to non-U.S. end-investors. FlexFunds sets up exchange-listed products, or what we call a Flex.

What types of assets can convert into bankable assets?

First of all, it is worth mentioning that the investment strategy is not limited to a particular asset type, as liquid, illiquid, listed, and alternative assets can be securitized. The treatment of these transactions as debt by the private bank allows a FlexFunds’ ETP to reach this distribution platform quickly. The agility of this process contrasts with the tedious and lengthy schemes of traditional funds, which are subject to complex verification procedures, given the KYC policies of private banks.

What is the conversion process?

Converting assets into bankable assets through an ETP is straightforward for our clients. FlexFunds takes care of the ETP issuance process, corporate administration services, and fund accounting, making the ETP ready within six to eight weeks. Thus, once the entire process is complete, the advisor can market this product, which has brought together several assets, in a single investment vehicle.

In just five simple steps, any given client can launch his ETP , facilitating access to investors in the global capital markets. Let us recap these steps:

- Design the investment strategy of the ETP.

- Sign the Engagement Letter.

- Due Diligence.

- Creation of the ETP.

- Issuance of the ETP.

About ETPs and their future

Exchange-traded products (ETPs) track underlying securities, an index, or other financial instruments. ETPs are traded on exchanges like stocks, with prices that may fluctuate daily and intraday. Thus, the value of ETPs oscillates according to changes in the value of the underlying assets.

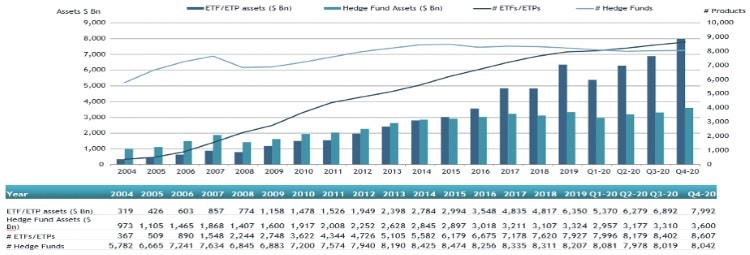

Since the debut of the first ETF in 1993, these funds, and other ETPs, have grown significantly in size and popularity. According to ETFGI (an independent ETF and ETP research and advisory firm), in 2020, globally, ETFs had more than $7 trillion in total assets under management (AUM). The low-cost structure of ETPs has contributed to their popularity, attracting assets, and drawing them away from actively managed funds, which are characterized by having a higher cost.

Trends to 2025

In Accenture’s report on the megatrends that will prevail by 2025, the asset managers consulted said the predominant focus will be developing customized solutions. Something that significantly benefits ETPs, which are products developed by private asset managers, is setting up a custom-made investment fund listed on an exchange.

Among other trends, they foresee a scenario highly dominated by technologies such as AI and autonomous learning to generate advantages over competitors while offering greater value to clients.

The report explains that “these trends could open the door for wealth managers to expand their business models to capture untapped potential,” primarily related to non-bankable assets, which “represent a significant and growing portion of an individual’s total wealth today.”