ETFs are a type of exchange-traded fund managed by a third party and aim to replicate the performance of underlying assets; according to PWC, they are among the top three investment options in the U.S. by 2022 and projecting to exceed US$20 trillion in assets under management by 2026. How will they achieve this, and why are they a good alternative?

Motivated by the promising prospects of these investment vehicles, more and more financial advisors are adopting ETFs and including them in the portfolios they design for their clients.

Not for nothing, this investment vehicle during 2021 garnered a 64% recommendation rate by financial advisors in the U.S., above other popular options such as mutual funds. (Statista chart).

The situation above replicates in other developed economies such as Australia, where the percentage of financial advisors recommending ETFs to clients “has more than doubled in the last 10 years,” according to the local Australian Financial Review.

An important attraction for financial advisors is that ETFs help them diversify their clients’ portfolios and offer them exposure to different indices or baskets of assets with transparency.

The wide distribution of ETFs allows investment advisors to offer their clients access to markets that might be challenging to enter and take advantage of betting on downside movements by benefiting from the underlying assets they are trying to replicate in their trading.

In markets with a scenario of volatility, high inflation, and rising interest rates, investment advisors are increasingly turning to active management and thematic ETFs over mutual funds, as seen in 2021, where companies like T. Rowe Price, Fidelity, and American Century bet on the ETF space.

It is key to have the backing and confidence to enter the ETF and ETP markets. Hence, companies like U.S.-based FlexFunds serve as a bridge, given its experience as a premier service provider for asset securitization. The company not only attends to the needs of investment advisors but also financial institutions, hedge funds, private fund managers, and real estate investment.

The defining characteristics of ETFs

From replicating an index such as Wall Street’s S&P 500 or the value of a commodity such as gold, ETF’s set up to be traded as stock market securities, offering investors liquidity.

In addition, another of the qualities of this investment product is the transparency it provides, since all the information on its performance is public and can be consulted in real-time, according to BBVA Trader.

According to the European deposit platform Raisin, the ETF’s structure has similar characteristics, however, existing some subcategories that differentiate them: how they replicate a particular index (direct or inverse), dividend distribution (accumulation or distribution), risk (normal or leveraged), among other variables.

ETFs vs. mutual funds

Despite their similarities, both have notable differences in the strategy applied by each one. While mutual funds adopt an active tactic to outperform the market, ETFs appeal to a passive scheme as they seek to replicate the behavior of the underlying basket of assets they track.

According to industry sources, ETFs have qualities that make them more attractive than mutual funds. The ETFs are seen as less risky and more flexible while offering better levels of liquidity. Still, different commission costs that investors must assume in each financial instrument must also factor in.

The U.S. investment management firm BlackRock explains in an educational module that in the case of ETFs, commissions are generated by buying and selling transactions through a broker or those derived from administration, in which case “they represent the largest and most variable part of the cost,” it says.

Other commissions may be related to legal procedures, custody services, and accounting aspects.

An increasingly attractive option

According to the global survey of the Finder platform, stocks, shares, or ETFs are the third most attractive investment option in the world for 2022, and 17.2% said that these would be the most profitable during the next 12 months.

The report indicates that the country most likely to invest its money in this market is Japan (44.3%), while in the U.S., these alternatives seduce 18%, ranking as the third-best option.

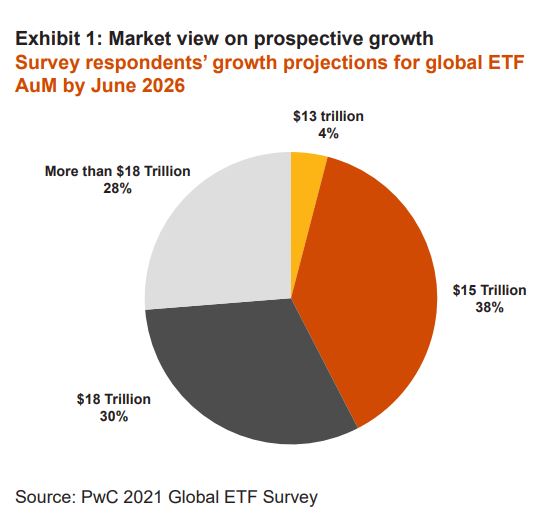

According to the PwC report, the ETF industry would have a compound annual growth rate (CAGR) of 17% in the coming years, reaching US$20 trillion by 2026 in assets under management.

Compared to the U.S. market, more than 70% of PwC survey participants, executives from the global asset management industry, project that assets will double in the coming years to US$13 trillion by 2026. The good business dynamics extend to Asia-Pacific, with projections of US$2 trillion in assets under management in that region, or Canada, where the target is US$1 trillion. Globally, “more than half of the executives surveyed believe that global ETF AUM will reach at least US$18 trillion by 2026 (14.6% CAGR),” the report says. (PwC chart):

These favorable forecasts are mainly supported by the fact that the exchange-traded fund business is undergoing changes, from digital to its diversification. Non-traditional products such as thematic or crypto ETFs expand the potential of this business and incentivize the updating of regulation at the pace demanded by today’s innovation.