The hedge fund industry reached US$4 trillion in assets under management for the first time in its history last year despite the disruption caused by the pandemic to their schemes of work. In 2022, new investment opportunities lie ahead for hedge fund managers, focusing on six aspects vital to their competitiveness. What are they?

In 2021, hedge fund returns were double digits; the industry experienced a promising period after slower progress in assets under management at the beginning of the year.

Thus, the Fund Weighted Composite Index (FWC) of Hedge Fund Research, Inc. (HFRI) advanced 0.5% in the fourth quarter of last year, bringing the 2021 return to 10.3%.

As explained by U.S.-based FlexFunds, hedge funds seek to maximize investor returns in various market scenarios and with different strategies, ranging from lower-risk to much more active.

The pandemic has generated important changes in hedge funds’ actions, several of which are equivalent to years of work, from technology and cybersecurity to the relationship between the firms and investors, according to FlexFunds.

Hedge Fund Research (HFR) analyzes in a report that “year-end capital flows also indicated that institutions are actively and tactically rebalancing portfolios across strategies, sub-strategies, and firm sizes.“

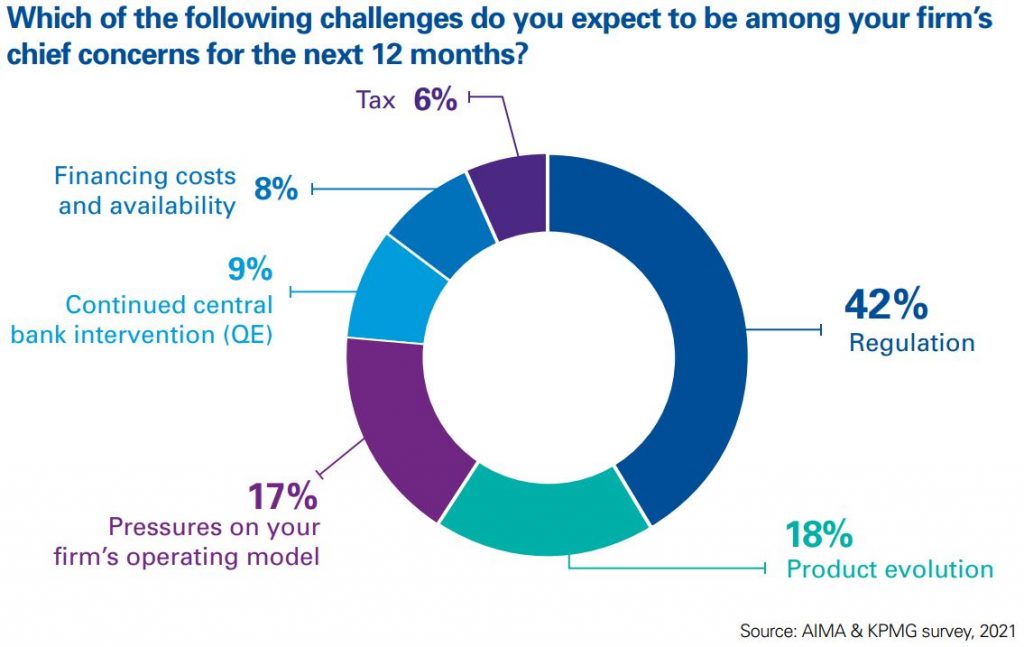

The year 2022 brought new challenges for hedge fund managers, with regulatory issues being the most significant challenges to be faced in the next 12 months for 42% of those surveyed in KPMG’s Global Hedge Fund Industry: Accelerating out of the pandemic report. The report recalls that “since the global financial crisis of 2008, a wave of new regulatory scrutiny has emerged around the world to create greater transparency and oversight of well-established business practices,” something that will surely be on managers’ radar this year.

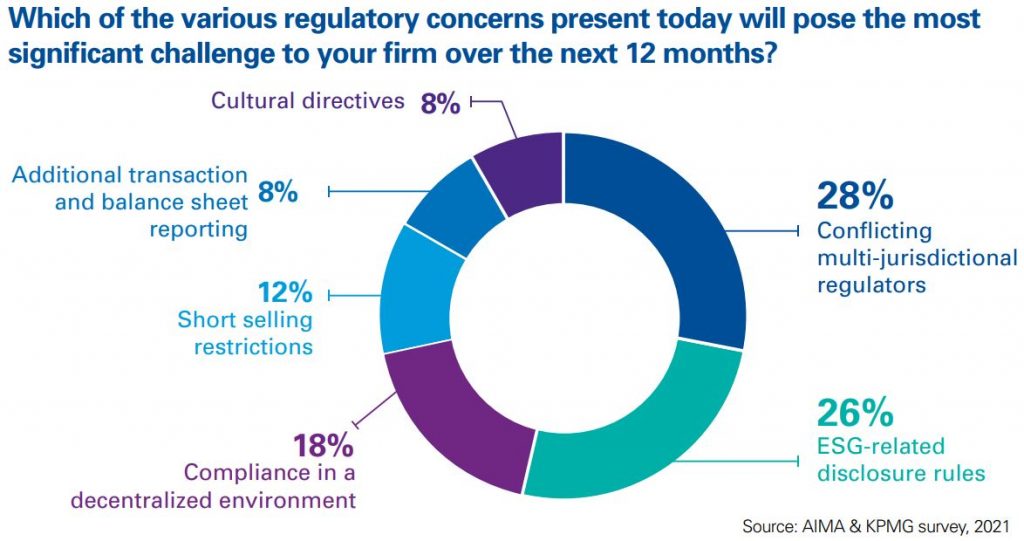

It further explains that aspects like Brexit or other jurisdictional changes have led to transformations in the firms’ dynamics, challenging hedge funds to be constantly updated. It also teaches them to be attentive to the changes introduced by the new investment vehicles that are bursting onto the markets.

Specifically, Hedge Funds seem most concerned about the so-called conflicting multi-jurisdictional regulatory frameworks, with 28% saying that this is the main challenge in this area, followed by ESG-related disclosure rules (26%).

The list of challenges envisioned by these funds also includes product evolution (18%) and pressures on companies’ operating models (17%) that, after the pandemic, forced many of these organizations to accelerate aspects such as their technological transformation even though many were unprepared.

A fourth challenge has to do with a possible continuation of central banks intervention, at a time when an interest rate hike of at least 150 basis points by the Federal Reserve in March taking for granted to address the escalation of inflation, which stood at 7.5% in January.

And although less pronounced, other challenges that hedge funds see are related to funding and availability costs (8%) and aspects associated with the tax burden (8%).

A volatile period

In January this year, hedge fund momentum slowed with the Fund Weighted Composite Index (FWC) down 1.7%. Still, macro hedge funds scored solid gains in a month marked by volatility felt in equity and fixed income markets, according to a report released by Hedge Fund Research (HFR).

On their performance, HFR President Kenneth J. Heinz analyzed that this result demonstrates “both capital preservation and protection against portfolio volatility as U.S. inflation reached levels not seen since the early 1980s.”

In 2022, hedge funds will adjust their strategies, focusing on inflation and interest rates while closely monitoring the performance of commodities. According to the same sources, other factors to consider are mergers and acquisitions, as well as “selective exposure to hedged equities.” Hedge funds tactically positioned for these dynamic macroeconomic and geopolitical risks and opportunities are likely to lead sector performance during a volatile first half of the year.