What is an index fund? and what are its characteristics? How does it work? Along these lines, we will answer these questions. In addition, we will also mention the formula to access index funds from Mexico and how they are presented to the real estate market.

What is an index fund?

An index fund is a Collective Investment Institution (CII) with an investment policy based on reproducing the behavior of a certain market index.

In this type of fund, the manager’s work is secondary: it is only a question of constructing a portfolio that replicates the index taken as a reference and making periodic adjustments to keep it updated according to the changes in the index.

For this reason, the index management philosophy is also called “passive management.”

Among the main characteristics that define index funds are the low management fees they charge, precisely because they do not have active management, and the manager’s intervention is hardly necessary.

How do index funds work?

The operation of index funds is simple. These financial products are investment funds; therefore, they are joint assets, without their legal personality and managed by a fund manager.

For an investment fund to remain active, two types of entities must be involved:

– The managing entity is in charge of administration.

– The depository entity is responsible for the custody of securities and cash.

The management company itself can issue and redeem shares, guaranteeing liquidity for the investor.

The manager can follow the index’s composition and buy the securities in the same proportion; in other words, physically reproduce the portfolio. However, it can also use financial derivatives such as futures whose underlying is the reference index itself. The fund’s regulations determine all these characteristics.

The indexes taken as reference (benchmarks) can be fixed income and equity. There are also sector, global, and commodity indexes. Thus, there are index funds of various categories.

What is the performance of an index fund?

The idea behind index funds is to replicate market movements and not to try to beat the market.

An index is simply a statistical calculation (usually a weighted average) of the most representative stocks traded on a particular financial market (those with the largest capitalization and traded volume). Its purpose is to measure the performance of the market it represents as a whole.

The performance of an index fund is directly proportional to the behavior of the market to which it takes exposure and represents by the corresponding index.

“Tracking Error” is the ability of a fund to deviate from its benchmark, in other words, it is the ratio that measures the difference between the performance of a portfolio and its benchmark. In this sense, index funds tend to have a low tracking error.

As a general rule, the performance of an index fund is slightly lower than that of its benchmark; this is because fees and other expenses are discounted daily.

What are some of the most prominent index funds?

There are index-managed products that have delivered double-digit annualized returns in recent years.

However, at this point, it is necessary to remember that the returns of index funds depend on the performance of the market and not on the manager’s capabilities. Similarly, the risk is also associated with the volatility of the reference market.

The diversification of this type of fund is determined by the composition and calculation of its index.

In any case, the expertise of the fund manager, the tracking error, the volume of assets under management (since it defines its liquidity), or the fees applied are also parameters to be considered to determine the quality of an indexed investment fund.

On this basis, and only as exhibits, some well-known index funds are below.

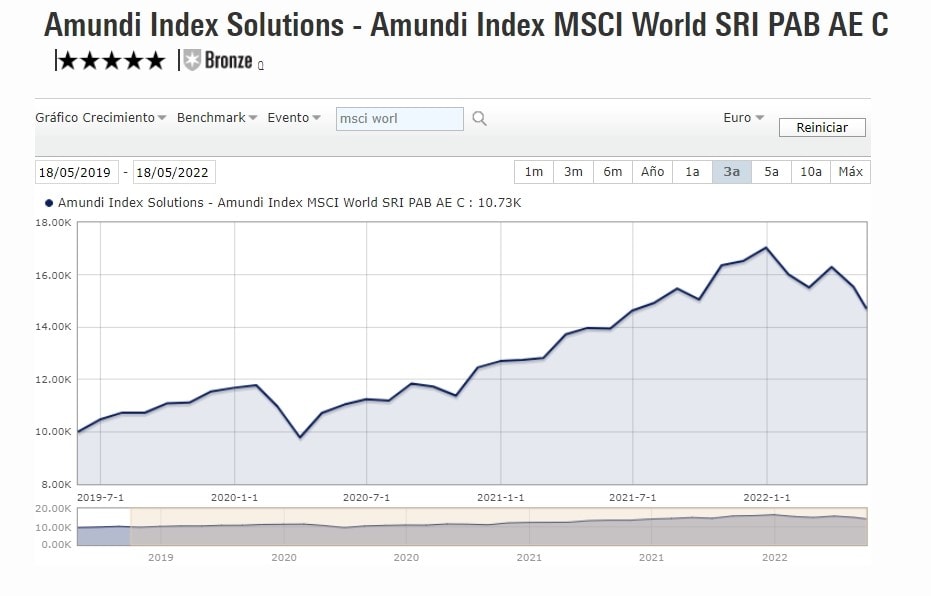

Amundi Index MSCI World SRI PAB

Amundi is the largest European fund manager by assets under management and one of the largest in the world. It is one of the leading firms in terms of passive management funds.

This case presents a global equity product that adopts socially responsible investment criteria: a fund indexed to the MSCI World SRI Index.

This selective index takes large- and mid-cap stocks listed on markets in 23 developed countries with outstanding environmental, social, or good corporate governance aspects. It excludes companies with a negative social or environmental impact.

Over the last 3 years, its annualized return has been 12.61% (as of May 18, 2022), and its current expense ratio stands at 0.35% (for Class AE C; ISIN: LU1861133657).

Vanguard US 500 Stock Index Fund

Vanguard is arguably the pioneer in passive management. Its founder, John Bogle, was the originator of index funds, at least in the public eye. For this reason, Bogle is now called “the father of low-cost investing.”

The fact is that Vanguard specializes in this type of investment philosophy and has a great deal of experience.

Its product portfolio includes the Vanguard US 500 Stock Index Fund. As its name suggests, this is a fund indexed to the Standard & Poor’s 500. It thus replicates the performance of the US stock market.

It has a compound annual growth rate over the last 3 years of 14.61% (as of May 18, 2022) and has a current expense ratio of 0.10% (for the USD Acc class; ISIN: IE0002639775).

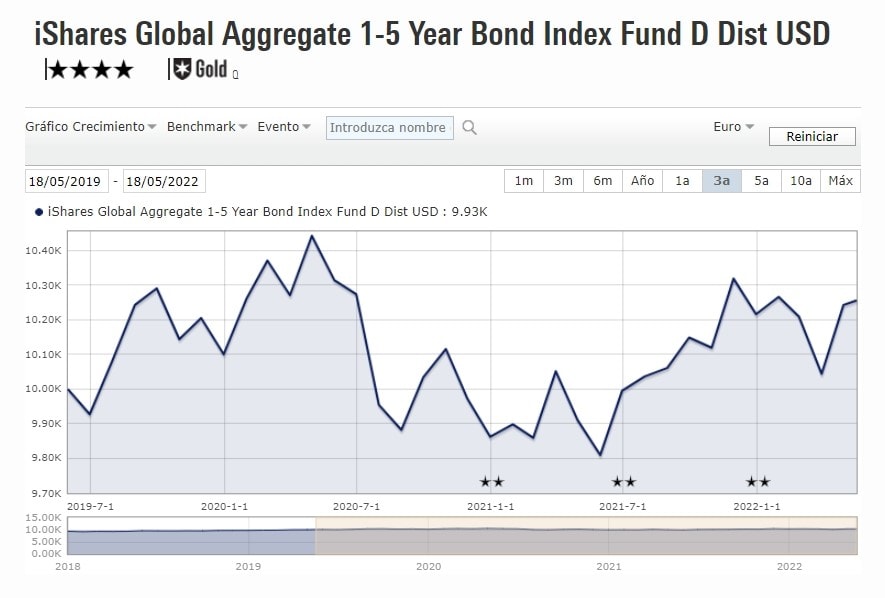

iShares Global Aggregate 1-5 Year Bond Index Fund

This time we enter the realm of global fixed income, showing that not all index funds have to replicate stock markets.

iShares, BlackRock’s passive management platform, presents a fund benchmarked to the Bloomberg Barclays Global Aggregate 1-5 Year.

This index measures the performance of investment-grade fixed-income assets with a maturity between 1 and 5 years from public and private issuers, including those issued by entities in the securitization sector worldwide in various currencies.

Over the last 3 years, its annualized return has been 1.06% (as of May 18, 2022) and has a current expense ratio of 0.15% (for class D Dist USD; ISIN: IE00BF2MW353).

Is it possible to find index funds in Mexico?

In the case of the Mexican market, it is also possible to find indexed funds. However, are listed most of them as ETFs (Exchanged Traded Funds).

ETFs are investment funds whose shares are listed on a stock market, just as if they were equities.

ETFs are open investment vehicles with the ability to issue or redeem shares in the market to provide liquidity. They provide more flexible trading.

On the other hand, ETFs have also indexed management products (the vast majority). They thus serve the same purpose as index funds: to provide exposure to a financial market represented by an index. The only difference is the structure in setting up the investment vehicle.

In summary, the operation to subscribe to indexed funds in Mexico varies. It is necessary to go to the stock market and buy shares. ETFs are available on the Mexican Stock Exchange (BMV) or the Institutional Stock Exchange (BIVA).

Are there any real estate index funds?

There are also global indexes for the real estatesector. Among them, the FTSE EPRA/NAREIT range stands out.

Index funds can be found in the real estate sector. The best example is the Amundi Index FTSE EPRA NAREIT Global AE-C (ISIN: LU1328852659).

However, as is the case with index funds in Mexico, many of the real estate investment vehicles have an ETF structure.

Some examples could be:

- The Real Estate Select Sector SPDR Fund (XLRE).

- iShares US Property Yield (IDUP)

- Invesco Real Estate S&P US Select Sector (XRES).

Exchange-traded products represent a good alternative for structuring real estate funds. They allow for agile trading, provide flexibility, and are scalable. They are one of the most widely used formulas for structuring investment vehicles.

Setting up an ETP (Exchange Traded Product) issuer is easy with our Flex Private Program. This solution is designed for real estate investment funds, private investment funds, and hedge funds.