- This is a general guide to understanding a hedge fund and how they are commonly set up.

- Ideal for fund managers, advisors, and financial enthusiasts who want to know how hedge funds are used.

- FlexFunds allows you to securitize a hedge fund cost-efficiently, facilitating access to international investors and extending its distribution reach to private banking.

A complete step-by-step guide to setting up a hedge fund.

Within the financial industry multiple collective investment vehicles allow diverse savers and investors to place their funds to protect and grow it.

Among the most popular are the so-called hedge funds, which, as their name suggests, focus on hedging participants from stock market swings.

Here is a step-by-step guide to designing and setting up a hedge fund based on various external expert opinions if you are an experienced advisor or portfolio manager.

What is a hedge fund?

A hedge fund is an alternative investment vehicle explicitly created to earn a positive return regardless of the overall market’s performance, although this is not always achievable.

The particularity of hedge funds is that their management is active, so a hedge fund manager can invest in almost any asset and through any strategy, be it bearish, bullish, volatility, etc.

A hedge fund can provide higher returns in exchange for higher risk. For example, a hedge fund could invest 100% of the portfolio in shares of a single company. If the bet goes right, investors will make a lot of money; if it goes wrong, they will lose it all.

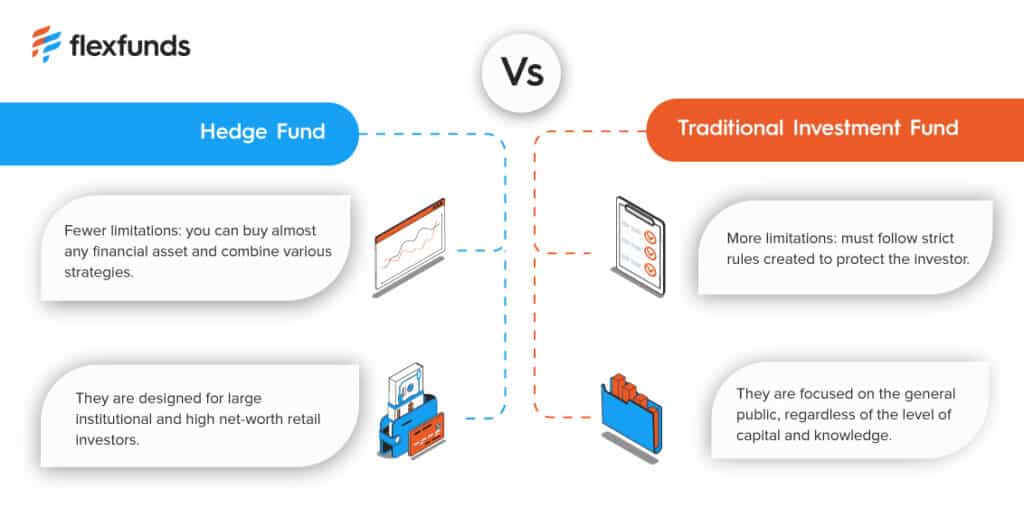

Hedge fund vs. investment fund.

It is essential to learn how to differentiate a hedge fund from an investment fund. As mentioned above; hedge funds have fewer limitations, they can invest in multiple liquid or illiquid assets, depending on the decision of the management team.

In contrast, a traditional investment fund has to follow a stringent set of rules created to protect the investor, usually a retail investor. Following the example above, a conventional fund could not invest 100% in a single asset because it would lack diversification, potentially increasing its risk.

Another difference between a hedge fund and an investment fund is that hedge funds aim at and cater to large institutional investors or high net worth individuals with significant assets. Traditional funds are usually available to a broader range of market participants, regardless of their capital or expertise.

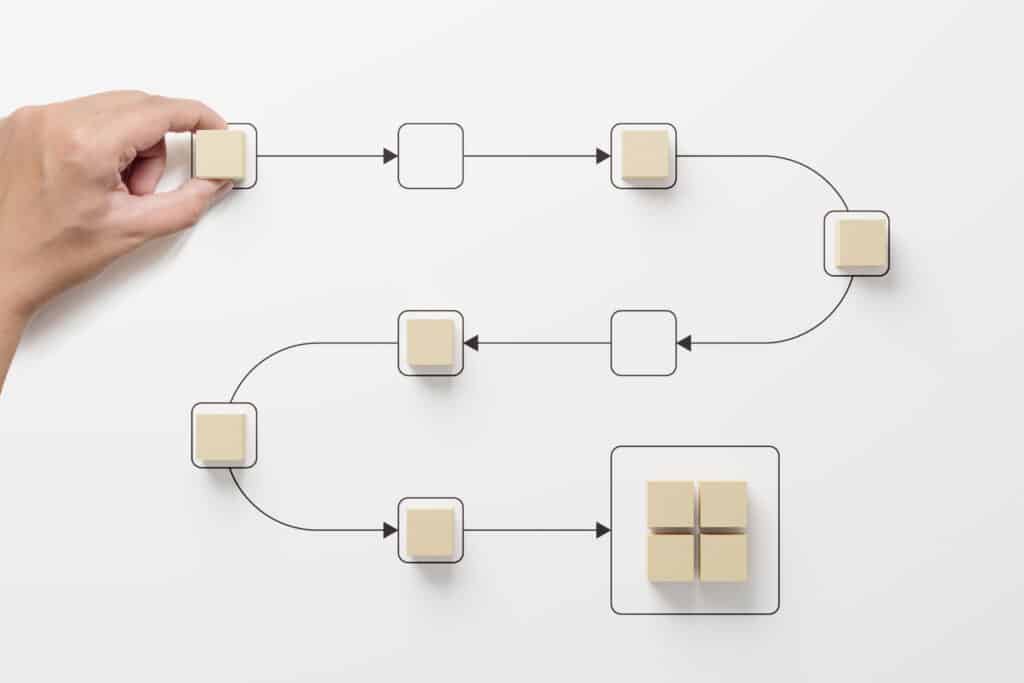

How to create a hedge fund step by step.

If you are an experienced advisor or portfolio manager and want to take a new step into the financial industry, you should know how to create a hedge fund step by step.

Step 1: acquire the necessary knowledge.

Creating a hedge fund is a complex task. Even if you have mastered the core financial skills and have a long history in the field, you should still inform yourself properly on how to create such an investment vehicle.

Because of the complexity of creating a hedge fund, it is necessary to inform yourself about its legal, operational, and financial aspects.

Step 2: Choose an operating strategy.

After acquiring the necessary knowledge, you must choose the operating strategy for setting up a hedge fund. While there are many, and some may be complementary, three stand out:

- Neutral strategy: a hedge fund of these characteristics invests in a series of assets with upside potential and trades down those with downside potential through short sales or financial derivatives.

- Hedged equity strategy: the objective is to protect a portion of the portfolio by trading down only a portion. Instead of seeking near neutrality as in the previous strategy, there is an underlying bullish view in this case.

- Macro strategy: macro strategy hedge funds invest following the world’s major economic movements or a particular economy. In some cases, financial derivatives take advantage of upward momentum.

It is essential to define whether the hedge fund strategy will be neutral, capital hedged, or macro to know which assets to trade, in what amount, and in what form.

Step 3: Get advice from legal specialists.

Once you have decided what kind of hedge fund to set up and know how to manage and set it up, it is essential that you contact a legal advisory team so that you can operate freely within the framework of the law. After all, your objective will be to manage third-party money.

A legal consulting team will allow you to develop the collective investment vehicle according to the regulatory parameters of the moment.

Step 4: learn to attract clients.

If you have a long track record in the market as an advisor or portfolio manager, then you have a significant network of contacts and potential clients. However, today, you must learn how to attract new users through digital marketing strategies or collaborations with large investment platforms.

As this is a large, ambitious, and professional project, you must ensure that you have marketing specialists to manage your hedge fund’s communication and advertising campaigns.

The hedge fund will thrive with customers, so you must learn how to engage audiences through digital and conventional strategies.

Why securitizing a hedge fund is important.

After creating your hedge fund, you can consider securitization to increase its distribution. This process involves converting an asset or group of liquid or illiquid assets into an exchange-traded product (ETP).

Through our FlexFeeder you can securitize your existing hedge fund, quickly expanding the international investor base that can access to subscribe to your fund.

By converting hedge funds into listed securities with their ISIN codes, investors could buy and sell them through their own brokerage accounts as if they were exchange-traded funds.

To securitize your hedge fund, feel free to visit our guide on how to do it practically and efficiently in just five steps, and if you wish to start the securitization process of your existing fund, don’t hesitate to get in touch with us.