Portfolio securitization is a financing mechanism to convert certain assets into marketable securities. Asset securitization is an instrument that provides liquidity to companies allowing them to leverage their projects, improving market efficiency, and reducing intermediation.

Among the various financing options, securitization occupies a suitable place for companies by allowing them to obtain the liquidity they need from those assets that allow them to generate income now or in the future without resorting to equity offerings or leverage.

Through this instrument, a portfolio of either liquid or illiquid assets is repackaged and placed as collateral to raise capital in the market utilizing securities, thus enabling companies to acquire liquidity to carry out their projects. Under this instrument, companies sell their cash flows to finance themselves, backed by their accounts receivable.

Thanks to securitization, it is possible to structure these securities backed by the performance of assets such as real estate projects that have “predictable revenues that are expected to continue during the ordinary course of their business,” says IDB Invest, an arm of the Inter-American Development Bank that supports the private sector. In the example above, this could be cash flows from leasing specific real estate.

From another perspective, it can provide liquidity to companies by allowing them to finance themselves through the issuance of securities backed by their portfolio, including a set of mortgage and consumer loans. Securitization allows the portfolio is then sold to an investor, thus assigning the rights to payment and its yields.

IDB Invest indicates that “the flows generated by the company are used to pay the debt service to the investors on the financing.”

Boosting companies through financing

Faced with the current financing challenges in international markets, with high-interest rates to contain the global inflation that emerged after the pandemic. The companies aim to diversify their sources of finance to boost their development and meet their goals in an environment of skepticism before a global recession.

In times like these, securitization adds dynamism to the capital market by opening the doors to more players by creating these securities. Simultaneously, it contributes to better flow of resources.

On the companies’ side, securitization allows them to leverage their projects and boost their growth by obtaining greater liquidity, without the need for them to access additional debt and with the advantage of transfering part of the risk to the market.

For the U.S. investment management firm BlackRock, securitization is an instrument that needs to be understood, either because of its complicated structure or simply because it needs to be sufficiently prominent.

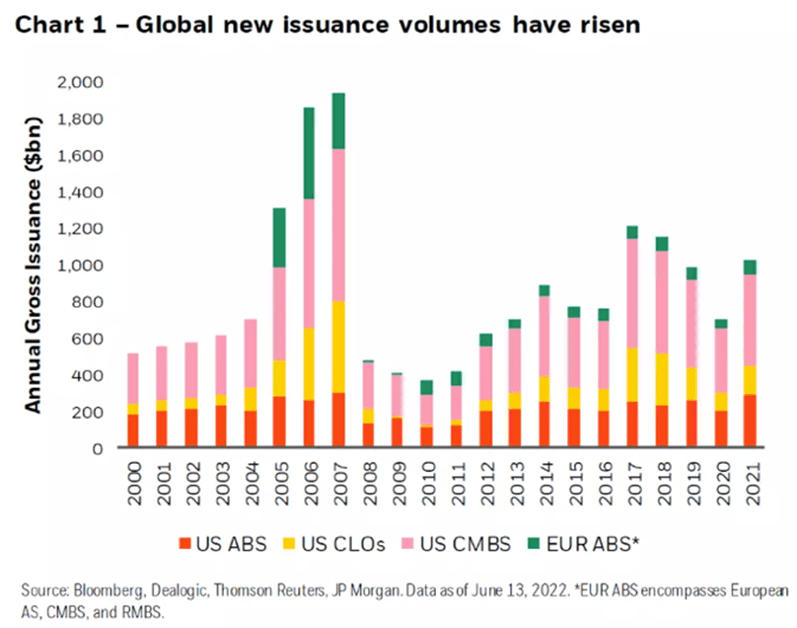

This can largely be explained by its role during the 2008 financial crisis, when the asset and mortgage securitization market contracted by almost 80% during the subprime crisis, according to a report by Financial Services of London (IFSL).

According to BlackRock, much has changed since then, “the securitized market has become a robust sector that should be a staple in fixed-income portfolios”.

This can sum up the lessons of the financial crisis, mainly in regulatory mechanisms that have given financial markets greater maturity and tools for investors to protect themselves against these eventualities, making it less likely that a situation like that of 2008 will happen again.

Analysts note that in the current landscape, the securitized market is no longer over-leveraged, with asset-backed securities (ABS) and commercial mortgage-backed securities (CMBS) set to regain their pre-financial crisis levels, according to BlackRock statistics.

Looking ahead to 2023, which will continue to pose challenges in financing, particularly in segments such as Venture Capital in the face of difficulties in accessing fresh capital amid the winter faced by startups, portfolio securitization is positioned as a suitable option. Regardless of market conditions, asset securitization is an alternative due to its low correlation with current traditional investments.

Sources:

- https://idbinvest.org/en/blog/financial-institutions/what-future-flow-securitization-and-what-are-benefits

- https://www.blackrock.com/institutions/en-us/insights/the-case-for-securitized-assets

- https://www.rtve.es/noticias/20090414/titulizacion-activos-hipotecas-cayo-todo-mundo-casi-80-2008/264266.shtml