Mutual funds, like hedge funds, are professionally managed. However, they have significant differences, ranging from their structure to the type of investments they usually encompass. One must consider aspects such as the risk level, each investor’s profile, and the exposure they offer when choosing a fund. What are they, and which are their main advantages?

FlexFunds, a leading service provider in asset securitization, explains these funds’ main features and differences.

What are mutual funds, and why are they so popular?

On the one hand, mutual funds are an investment instrument that receives subscriptions of different nature to invest in various assets ranging from stocks to bonds under the management of a professional advisor.

Mutual Funds have the support of investment advisors, those who opt for this alternative guide their decisions by these specialists according to their risk profile and do not have to worry about developing a strategy, as is the case with other alternatives.

There are different types of mutual funds in the market, such as those that focus on fixed income, which has a more conservative profile, and target instruments such as government bonds.

For higher-risk profiles, there are also equity mutual funds, which have a longer-term projection and adopt a more aggressive strategy to obtain returns from the stock market, which tends to be more volatile than government debt instruments.

And the third type of mutual fund is called mixed, which includes a combination of fixed income instruments such as bonds and equities such as stocks, structured for a moderate profile type.

In addition to being professionally managed, other advantages of mutual funds include that they are an alternative to diversifying portfolios by offering exposure to various asset classes for different risk profiles.

The Investment management firm BlackRock notes that “mutual funds offer an affordable way to invest in a wide range of stocks without paying transaction fees for each share held.”

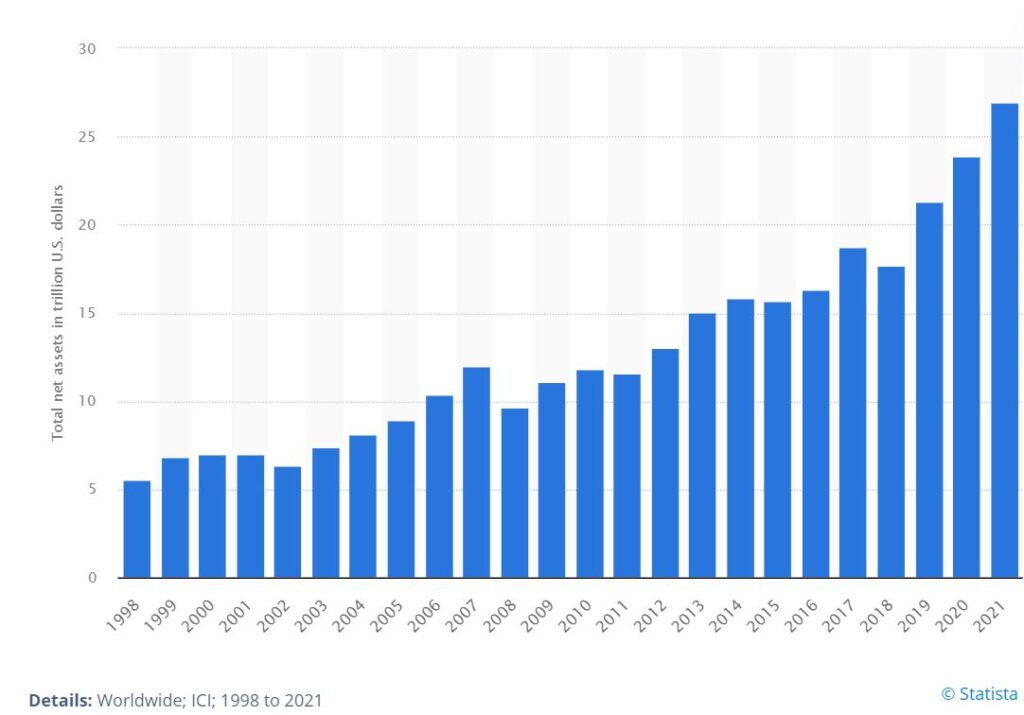

According to figures from Statista, assets under management (AUM) of registered mutual funds in the U.S. soared from US$5.53 trillion in 1998 to US$27 trillion in 2021.

Estimated to be more than 7,000 domiciled mutual funds in the U.S., equity funds are among the most popular in the country, accounting for 43% of all assets in 2020 alone, according to German statistics portal Statista.

Hedge funds, an alternative for specialists

Unlike mutual funds, this type of instrument is designed for more specialized profiles since they use much more aggressive strategies to extract higher returns from the markets, despite being structured similarly to their peers.

The Raisin savings platform highlights that these funds come to offer “returns well above the market and any other investment fund subject to greater regulation.” At the same time, “they are very flexible in terms of asset type, leverage or the geographical area in which they invest, allowing them to take advantage of any investment opportunity that arises.”

These funds try to take advantage of any market behavior, so they can even make profits when there are bearish cycles, leveraging strategies such as short selling.

This tactic consists of selling assets at a higher price when a bear market cycles and then repurchasing them through a broker at a lower price to benefit from the difference generated by the depreciation.

The main subgroups of hedge funds include those known opportunistic, which use short selling techniques, and others based on short and long positions.

Other subgroups of hedge funds include those that focus on the relative value of assets and seek to exploit returns by analyzing potential valuation miscalculations. Other funds keep an eye on relevant events that affect organizations’ current status and seek to take advantage of pricing inefficiencies that may arise due to a particular situation, such as a merger or acquisition.

According to Reuters, hedge funds reached the milestone of managing US$4 trillion globally for the first time in history at the close of 2021; in addition, they “recorded double-digit annual returns.”

This year has brought new challenges for the industry. Hedge Fund Research (HFR) recently reported declines in hedge fund returns, in line with the volatility in the financial market following solid gains in the first quarter.

The HFRI 500 index “declined -0.5% in May, with macro hedge funds trimming strong year-to-date gains, while event-driven strategies led the declines,” that entity reported.

Given this scenario, each asset manager can structure the instrument and type of fund that fits the risk profile of each investor: an institutional one, betting on hedge funds or a much less experienced one that opts for an alternative such as a mutual fund in which it can count on the accompaniment of an advisor to develop a strategy.

In any case, the outlook for asset management is as challenging as it is promising. The British firm PwC in its report Asset & Wealth Management Revolution: Embracing Exponential Change, projects that assets under management (AuM) will double in size by 2025 to US$145.4 trillion, generating multiple opportunities for the industry.

Sources:

- https://www.blackrock.com/us/individual/education/mutual-funds

- https://www.statista.com/statistics/255518/mutual-fund-assets-held-by-investment-companies-in-the-united-states/

- https://www.raisin.es/inversion/fondos-de-inversion/fondos-de-cobertura/

- https://www.reuters.com/business/finance/global-hedge-fund-industry-assets-top-4-trillion-first-time-2022-01-20/

- https://www.hfr.com/news/hfri-500-index-posts-mixed-decline-in-may-as-financial-market-volatility-accelerates

- https://www.pwc.com/ng/en/press-room/global-assets-under-management-set-to-rise.html